Losing a husband is one of the most painful experiences in life. Along with emotional loss, many widows in Pakistan also face serious financial challenges. To support senior citizen widows, the Government of Pakistan provides a widow pension, also known as family pension. This financial assistance helps cover daily expenses and provides stability after the death of a spouse.

If your husband was a government employee or pensioner, you can apply for family pension through the relevant department. In private-sector cases, the pension is handled by EOBI (Employees’ Old-Age Benefits Institution). This complete guide explains the widow certificate union council check, required documents, and bank account verification process in simple, easy-to-understand English.

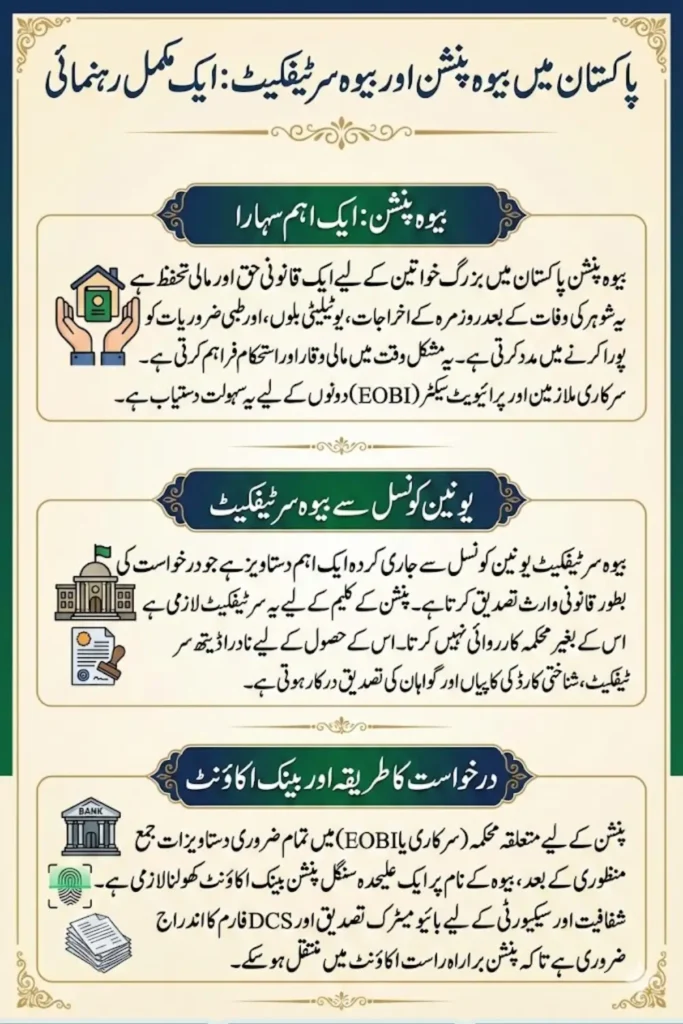

Widow Pension and Widow Certificate in Pakistan

Widow pension is a legal right for eligible widows in Pakistan. It ensures financial support after the death of a husband who was either serving in government service, retired, or registered under EOBI.

You can also read: 8123 Ration Card Eligibility Check Online

The process may look complicated at first, but once you understand the steps, it becomes manageable. The key is proper documentation and timely submission.

Why Widow Pension Is Important for Senior Citizens

For many families, the husband is the main earning member. After his death, income suddenly stops. Widow pension acts as a safety net.

It helps:

- Cover monthly household expenses

- Pay utility bills

- Manage medical costs

- Provide financial dignity in old age

Without this support, many widows would struggle to survive.

Difference Between Widow Certificate and Family Pension

A widow certificate is issued by the Union Council. It officially confirms that the woman is the lawful wife of the deceased.

Family pension, on the other hand, is the monthly financial payment given after verification. The widow certificate is one of the most important documents required to claim that pension.

Who Can Apply for Widow Pension in Pakistan

Not every case qualifies automatically. Certain eligibility conditions must be fulfilled.

Government Employee Cases

The widow of:

- A retired government employee

- A serving government employee who died during service

- A government pensioner receiving monthly pension

is eligible for family pension under government rules.

Pensioner and In-Service Death Cases

If the husband died while still working, the department processes the case based on his service record. If he was already retired, the pension simply transfers to the widow after formal verification.

In some legal cases involving multiple widows, pension may be divided according to government regulations.

Private Sector and EOBI Cases

If the deceased worked in the private sector and was registered with EOBI, the widow must apply through EOBI offices. The pension amount depends on contribution history and service duration.

What Is a Widow Certificate from Union Council

The widow certificate is an official document issued by the local Union Council. It verifies that the applicant is the lawful wife of the deceased person.

Without this certificate, most departments will not process the family pension claim.

Purpose of Widow Certificate

This certificate confirms:

- Legal marital status

- Death of husband

- No dispute regarding marriage

- Identity verification

It protects government departments from fraudulent claims.

How Union Council Verification Works

The process usually includes:

- Submission of NADRA death certificate

- CNIC copies of widow and deceased

- Witness verification

- Local record confirmation

After checking the records, the Union Council issues the widow certificate.

Required Documents for Widow Pension Claim

Documentation is the backbone of pension approval. Missing documents can delay the process for months.

Basic Identification Documents

You will need:

- Original NADRA death certificate

- Copy of widow’s CNIC

- Copy of deceased husband’s CNIC

- Lawful widow certificate from Union Council

- No remarriage certificate

Service and Pension Records

Additional documents include:

- Last pay slip (if died in service)

- Pension book copy (if retired)

- List of family members with dates of birth

- Revised CSR-25 Family Pension Form

Attestation and Affidavit Requirements

In some cases, departments require:

- Notary-attested affidavits

- Verification from gazetted officer

- Bank verification forms

Proper attestation ensures faster approval.

You can also read: Punjab Phase 2 Laptop Scheme Start

Step-by-Step Process to Apply for Widow Pension

The procedure is straightforward but requires careful attention.

Document Collection

Start by gathering all required documents. Make sure copies are clear and properly attested.

Double-check:

- CNIC numbers

- Name spellings

- Dates of birth

Small mistakes can cause major delays.

Form Submission to Relevant Department

Submit documents to:

- Husband’s government department (for government cases)

- AGPR (for federal cases)

- EOBI office (for private sector cases)

The department verifies service history and eligibility.

Verification and Approval Process

After submission:

- Service record is reviewed

- Pension calculation is completed

- Approval order is issued

- Pension Payment Order (PPO) is generated

Once approved, the pension is transferred to the bank.

Bank Account Opening and Verification Process

A dedicated pension bank account is mandatory. Pension cannot be transferred to a joint or shared account.

Single Pension Account Rules

The bank requires:

- Opening a single account in widow’s name

- CNIC copy submission

- DCS option form

- Biometric verification

This ensures transparency and security.

Biometric and DCS Verification

Biometric verification confirms identity through NADRA system. The DCS (Direct Credit System) form allows pension to be deposited directly into the account.

Below is a summary of bank requirements:

| Requirement | Purpose |

|---|---|

| Single Pension Account | Prevent misuse of funds |

| CNIC Copy | Identity verification |

| Biometric Verification | Confirm living beneficiary |

| DCS Form | Enable direct monthly transfer |

After verification, the department sends payment instructions to the bank.

Life Certificate Requirement for Continued Pension

Widows must prove they are alive to continue receiving pension.

Submission Timeline

Life certificate must be submitted:

- Every March

- Every September

Verification can be done through the bank.

Consequences of Non-Submission

If not submitted:

- Pension payments may stop temporarily

- Re-verification will be required

- Delays may occur in future payments

Regular submission ensures smooth monthly payments.

Widow Pension in Private Sector (EOBI Procedure)

For private employees, the process is handled by EOBI.

Documents Required for EOBI Claim

- Death certificate

- Widow CNIC copy

- Marriage proof

- EOBI claim form

Processing and Payment Structure

The EOBI office verifies:

- Contribution record

- Service period

- Eligibility conditions

Payment amount depends on contribution history. Once approved, monthly pension is transferred to the widow’s account.

Common Problems and How to Avoid Delays

Many widows face unnecessary delays due to simple mistakes.

Common issues include:

- Incorrect CNIC details

- Missing widow certificate

- Incomplete forms

- Bank account errors

- Late life certificate submission

To avoid problems:

- Check documents twice

- Keep multiple copies

- Stay in contact with department

- Submit certificates on time

A careful approach saves months of waiting.

You can also read: PSER 8070 Ramzan Package Online Registration

Conclusion

Widow pension in Pakistan is a vital support system for senior citizen widows. The process involves obtaining a widow certificate from the Union Council, submitting required documents, opening a single pension bank account, and completing biometric verification. Government employee cases are processed through relevant departments or AGPR, while private-sector cases are handled by EOBI.

Although the process may seem detailed, it is manageable when done step by step. By keeping documents complete and submitting life certificates regularly, widows can ensure continuous financial support and security.

Frequently Asked Questions (FAQs)

Q1: How long does widow pension approval take?

It usually takes a few weeks to a few months, depending on document verification and department processing time.

Q2: Is widow pension paid for life?

Yes, it is generally paid for life or until remarriage.

Q3: Can children receive pension after widow’s death?

Eligible children may receive pension under family pension rules if they meet age and dependency conditions.

Q4: What happens if biometric verification fails?

The widow must visit the bank or NADRA office for re-verification to restore payments.

Q5: Is a widow certificate mandatory for all cases?

Yes, most government and EOBI cases require a lawful widow certificate issued by the Union Council.